Filing Form ADT-1 for Appointment of First Auditor

Is Filing of Form ADT-1 Mandatory for First Auditor Appointment?

There has often been confusion regarding whether Form ADT-1 must be filed for the appointment of the first auditor under the Companies Act, 2013. Let’s clarify this step by step.

Section Governing First Auditor Appointment

The first auditor is appointed under Section 139(6) of the Companies Act, 2013:

Provision for Filing Form ADT-1

Form ADT-1 is filed under the fourth proviso to sub-section (1) of Section 139 as per Rule 4(2) of the Companies (Audit & Auditors) Rules, 2014.

- It is primarily meant for auditor appointments under Section 139(1).

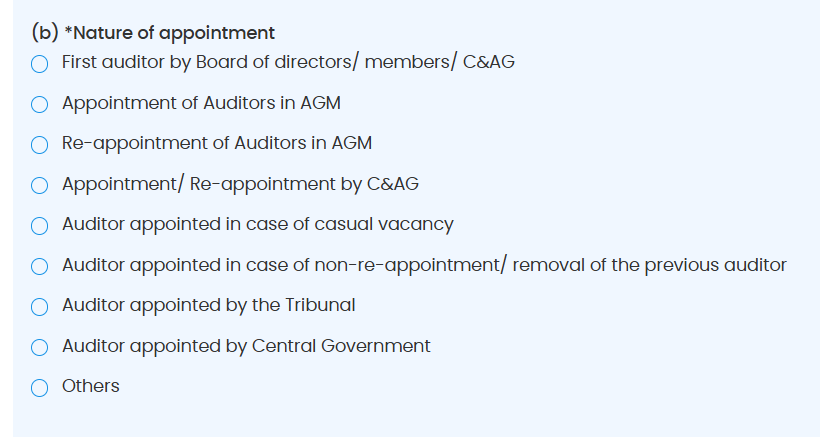

- Interestingly, Form ADT-1 also provides an option to indicate First Auditor Appointment.

MCA Clarification

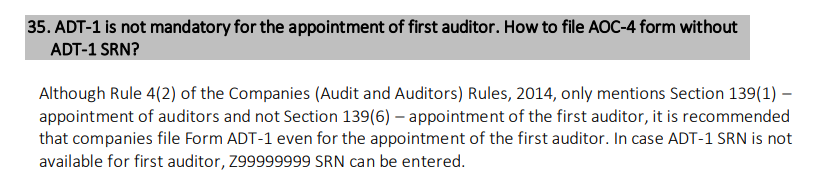

Previously, the Ministry of Corporate Affairs (MCA) had not explicitly stated whether filing ADT-1 was mandatory for first auditor appointments.

However, in the FAQs issued on 7th July 2025 regarding migration from MCA V2 to V3 (link), MCA clarified:

While filing Form ADT-1 is not mandatory for the first auditor appointment, it is recommended to do so for better transparency and record-keeping.

Key Takeaways

- Mandatory Filing: Not required for the first auditor under Section 139(6).

- Recommended Practice: Filing Form ADT-1 ensures proper disclosure and aligns with MCA’s suggested governance practices.

- Subsequent Appointments: Filing remains mandatory for auditor appointments under Section 139(1).